Dear All (wonkish alert: coffee up, settle in, and read the reports!),

As you will recall, WHO’s most current pipeline review found that globally we do not have sufficient innovation as yet to address current or future needs (Butler et al. AAC 2022; see also this newsletter as well as the amr.solutions webpage summarizing pipeline reviews and priority pathogen lists).

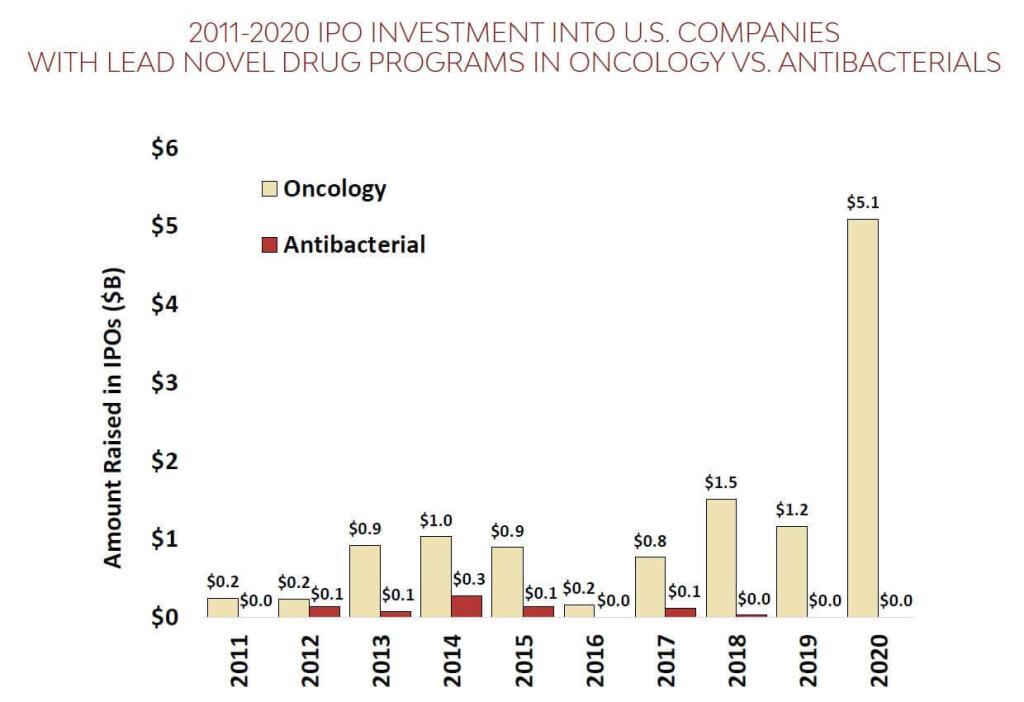

We can add to this with a superb new report from BIO on the state of the pipeline. Yes, there is ongoing Industry activity (on this, see the recently released 3rd report of the AMR Industry Alliance), but the core finding is pretty much the same as for the WHO report: the number of current antibacterial projects is distressingly small (only 44 after you remove projects for TB and C. difficile). The BIO report goes further to provide a stunning compare/contrast with therapies for cancer. For the period 2011-2020, the $ going to cancer companies was 17-fold greater than for antibacterials both in terms of VC funding and IPO-based funding:

(left) VC funding during 2011-202 for cancer companies was $26.5b vs. $1.6b for antibacterials; (right) during this same period, IPOs for 12 U.S. antibacterial-focused biopharma brought in just $0.7 billion over this period vs. $12b raised by 109 U.S. oncology companies.

Yup … that’s a 17-fold difference no matter which way you do the math. And this leads, of course, to real differences in the number of active R&D projects: There are 160 clinical stage drug projects for breast cancer alone vs. the meager 44 antibacterial projects.

As was noted so clearly in Jason Gale’s excellent 2019 podcast series, this disparity in investment leads to the possibility that “Yes, your cancer will be controlled, but then you may die of infection.” And the need for effective antibiotics is not limited to the cancer arena: per the recent GRAM report, “at least 1.27m deaths/year are directly attributable to AMR”, a number that is greater than the number of deaths/year for either HIV or malaria.

And although there is encouraging global regulatory convergence on endpoints and trial design, it is still expensive to develop new antibiotics (best guess: ultimately somebody has to spend an average of $1.7b to develop and then maintain each new drug — and these are real costs for programs that aren’t reduced because a company is small, non-profit, or otherwise doing a good deed) and programs are taking longer and having lower success rates as shown by FDA’s 2020 analysis of antibacterial development trends over 40 years (1980-2019). In short, it is very, very, VERY hard to find and develop the needed new antibacterial agents!

—

So, and as always, this brings us to the subject of Pull Incentives as the key tool to ensuring we have a long-term, vibrant antibiotic development ecosystem. This need for same has been endorsed by the G7 Health & Finance ministers and the European Commission as well as by the very existence of the UK “Netflix” pilot and the PASTEUR Act in the US.

As noted at the start of this newsletter, one of the AMR.solutions webpages provides a summary of papers and newsletters on Pull incentives and to that collection of papers we can now add two helpful new reports on Pull incentives. Together, they provide cogent analyses of the two leading ideas on ways to implement Pull (transferrable exclusivity and subscriptions):

- Jan 2022: “Reflection Paper on the Pull Incentive Mechanisms Suitable For SMEs Developing AMR Products in Europe” from the BEAM Alliance. This paper makes a strong case for the use of transferrable exclusivity mechanisms.

- Feb 2022: “The Case for a Subscription Model to Tackle Antimicrobial Resistance” is a paper commissioned by Wellcome Trust and the Novo Nordisk Foundation in advance of the 2022 World Economic Forum. This paper makes a strong case for a subscription model as a component of any system of Pull incentives.

These are both excellent analyses and well worth reading — my thanks to the authors. Taken together, the messages from BIO report, and GRAM report, and these new analyses of Pull incentives could not be clearer … we must act now to ensure that we have the antibiotics we need in the future! #AMRSOS!

All best wishes, –jr

John H. Rex, MD | Chief Medical Officer, F2G Ltd. | Operating Partner, Advent Life Sciences. Follow me on Twitter: @JohnRex_NewAbx. See past newsletters and subscribe for the future: https://amr.solutions/blog/. All opinions are my own.

Current funding opportunities (most current list is here):

- [NEW] ICARS– and IDRC-sponsored RFP on gender inequality in AMR (with a focus on sub-Saharan Africa) for proposals of up to $150k for a 9-12 month project. Deadline for proposals is 9 Mar 2022; go here for details.

- NIAID has released a four-pronged BAA (Broad Agency Announcement (HHS-NIH-NIAID-BAA2022-1) that covers therapeutics (antibacterial, antifungal, antiviral), vaccines (again, all 3 areas), and diagnostics. Lots of possibilities! The due date is 18 Mar 2022.

- BARDA is seeking proposals under Project BioShield to support late stage development, regulatory approval and potential procurement of antibiotics against biothreat pathogens, Yersinia pestis, Francisella tularensis, and Burkholderia pseudomallei. Small businesses can apply until April 6, 2022. Go here for the details.

- JPIAMR’s 14th call is now open. Entitled “Disrupting drug resistance using innovative design”, the call seeks consortia that would seek to “improve the treatment of bacterial and fungal infections (including co-infection) and/or the prevention of the emergence/spread of resistance in humans, animals or plants through the improvement of the efficacy, specificity, delivery, combinations and/or repurposing of drugs and plant protection agents.” Bacteria, fungi, human health, animal health, and plant health are all in scope! Pre-proposals are due 8 Mar 2022; full proposals would be due 5 July 2022. Go here for details.

- The AMR Action Fund is now open to proposals for funding of Phase 2 / Phase 3 antibacterial therapeutics. Per its charter, the fund prioritizes investment in treatments that address a pathogen prioritized by the WHO, the CDC and/or other public health entities that: (i) are novel (e.g., absence of known cross-resistance, novel targets, new chemical classes, or new mechanisms of action); and/or (ii) have significant differentiated clinical utility (e.g., differentiated innovation that provides clinical value versus standard of care to prescribers and patients, such as safety/tolerability, oral formulation, different spectrum of activity); and (iii) reduce patient mortality. It is also expected that such agents would have the potential to strongly address the likely requirements for delinked Pull incentives such as the UK (NHS England) subscription pilot and the PASTEUR Act in the US. Submit queries to contact@amractionfund.com.

- INCATE (Incubator for Antibacterial Therapies in Europe) is a newly launched early-stage funding vehicle. Details are still coming into focus, but per comments on 25 Aug 2021 at the BIOCOM conference, their goal is to support ~4 companies per year with about $250k/company. Contact details are on their website (https://www.incate.net/).

- CARB-X recently announced that their existing resources will be reserved to fund their existing portfolio (more than 80 total awards, and counting, as they include contracting from prior rounds). New rounds from CARB-X will occur only after new funding is obtained in 2021.

- It’s not a funder, but AiCuris’ AiCubator offers incubator support to very early stage projects. Read more about it here.

- The Global AMR R&D Hub’s dynamic dashboard (link) summarizes the global clinical development pipeline, incentives for AMR R&D, and investors/investments in AMR R&D.

- In addition to the lists provided by the Global AMR R&D Hub, you might also be interested in my most current lists of R&D incentives (link) and priority pathogens (link).

Upcoming meetings of interest to the AMR community (most current list is here):

- [If you missed it, you can now watch the video] 8 Dec 2021: “The New Winds Pushing and Pulling Antibacterial Development.” This FABULOUS program featured talks from the UK team behind the NHS “Netflix” pilot, Kevin Outterson’s recently released report documenting the need for global Pull incentives to have a value of $2.2 – 4.8b, and speakers covering PASTEUR and work in the EU on pull incentives. The video is here — please make time to listen to this program!

- [GRAM report launch video!]: The 4 Feb 2022 webinar for the GRAM (Global Research on Antimicrobial Resistance) report (“1.27 million deaths per year are directly attributable to AMR”) is now available for replay. #AMRSOS!

- 23 Feb 2022 (virtual, 8-9a EST): Pre-application webinar to provide more information and to answer questions. Register here.

- [NEW] 1 Mar 2022 (virtual x 2 sessions: 10.00-11.30 CET and 15.30-17.00p CET): WHO-sponsored webinar on their Essential Medicines List Antibiotic Book with an emphasis on how it can be used to support national action plans for AMR. Go here to register.

- 3 Mar 2022 (virtual, 2p GMT): The Longitude Prize (run by Nesta Challenges), CARB-X and FIND, have joined forces for a virtual event in March, AMR& Diagnostic Frontiers: Developing and increasing access to innovative diagnostics in and for low-and-middle-income countries (LMICs). Full agenda details and registration can be found here, including an invitation for diagnostic companies to pitch to a panel of global health representatives.

- 3-6 Mar 2022 (Albuquerque, New Mexico): Biannual meeting of the MSGERC (Mycoses Study Group Education and Research Consortium). Details are here.

- 6-11 Mar 2022 (Il Ciocco, Tuscany): Gordon Research Conference entitled “New Antibacterial Discovery and Development”. Go here for details, go here for the linked 5-6 Mar Gordon Research Seminar that precedes it.

- 9 Mar 2022 (virtual, and in-person): BioInfect Conference, Alderley Park, UK (near Manchester). This long-running Bionow-sponsored annual conference draws a very strong audience. Go here for details.

- 7-8 Apr 2022 (Basel and in person, we hope): The 6th edition of the annual AMR conference sponsored by the BEAM Alliance, CARB-X, the Novo REPAIR Impact Fund, the IMI Accelerator, and the European Biotechnology Network. Go here for the hold-the-date page and a way to be kept informed about the meeting.

- 9-13 May 2022 (Athens and online): 40th Annual Meeting of the European Society for Paediatric Infectious Diseases, Go here for details.

- 20-24 Sep 2022 (New Delhi): 21st Congress of the International Society for Human and Animal Mycology (ISHAM). Go here for details.

- 25-28 Oct 2022 (Stellenbosch, South Africa): The University of Cape Town’s H3D Research Centre will celebrate its 10th anniversary with a symposium covering the Centre’s research on Malaria, TB, Neglected Tropical Diseases, and AMR. Go here to register.