Dear All (and with thanks to Kevin Outterson for co-authoring this newsletter),

In the wake of the Sep 2024 UNGA HLM on AMR (UN General Assembly High-Level Meeting on AMR), it has been encouraging to see the continued discussion around Push and Pull incentives for antibacterial innovation and access (see the AMR.Solutions post-UNGA webpage for links). With strong progress on Pull incentives in the UK (19 Aug 2024 newsletter) and Italy (30 Jul 2025 newsletter), the particular hope now is that other high-income countries will implement complementary approaches to Pull that are appropriate for each territory.

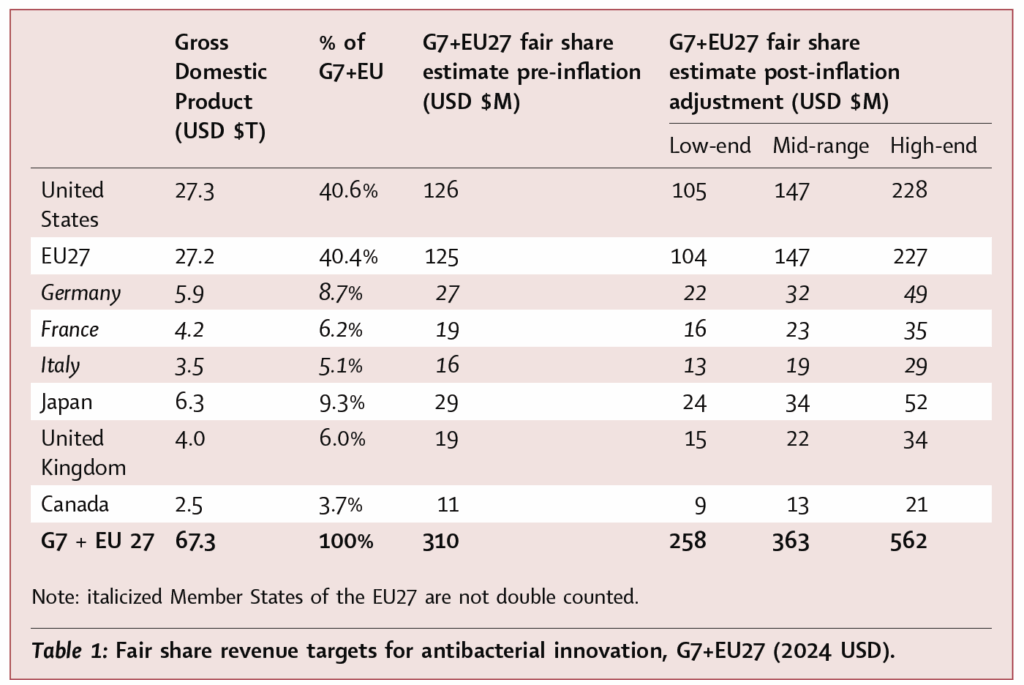

And with that desire, the question of “what is each country’s fair share?” becomes important. Previous work (see Kevin’s 1 Nov 2021 newsletter) estimated that a global Pull of $310m/year x 10 years (2019 US dollars, USD) would create an effective incentive (lower and higher bounds on the estimate were $220m/yr to $480m/yr). Note also that it is expected that the Pull awards come only from high(er) income countries.

In an effort to analyze progress to date, Kevin and colleagues offer this new open-access publication:

- Goh M, McEnany M, Freeman R, Newton M, Kesselheim AS, Outterson K. Bridging the fair share gap for antibacterial innovation: an observational analysis of antibacterial revenues in the G7 and EU27. eClinicalMedicine. 2025;88:103485, doi: 10.1016/j.eclinm.2025.103485.

In brief, the manuscript (i) updates the global fair share targets to 2024 USD, (ii) estimates actual by-country (G7 and EU27) revenue for two key representative antibiotics (cefiderocol and ceftazidime-avibactam) for 2015-2024, (iii) estimates by-country gaps, and (iv) puts into context the required costs to meet fair share goals. Let’s take a look!

The authors start by updating the fair share targets to 2024 USD. Using a standard adjustment for inflation, we have the table just below. Note that the only adjustment made to the prior modeling was to correct for inflation between 2019 and 2024:

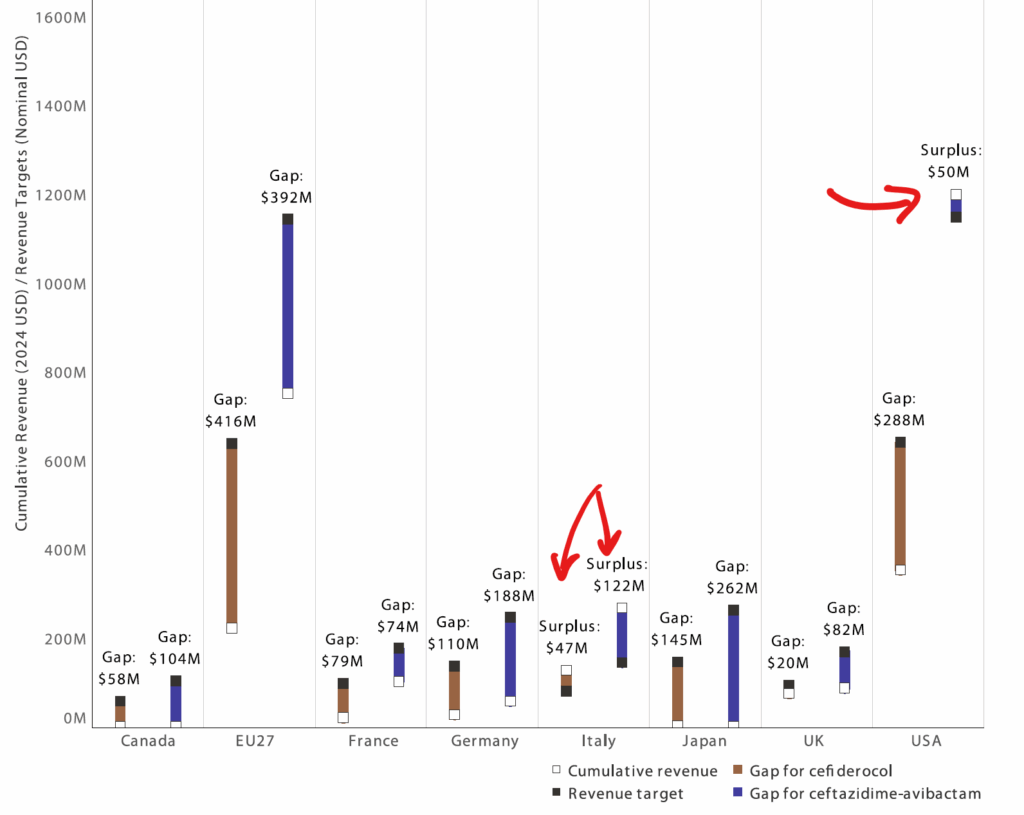

So, how did the countries do? The next figure in our tour shows cumulative revenue to date vs. mid-point target by country. Most of the countries have a gap between actual sales and fair share target (e.g., $58m and $104m for Canada for the two drugs … see the very first pair of columns). And, the EU27 as a whole (the next pair of columns) has a $800m gap. But, note that 3 instances are marked where sales revenue have now achieved fair share target (Italy for both test drugs, US for ceftazidime-avibactam) where the target is already met:

And this leads, in turn, to a pair of fascinating new analyses. First, the fact that we have 3 instances where revenue has achieved the by-country fair share target (just through needed use) says that meeting the target is not always, or consistently, an extra cost at the country level. Neither Italy nor the US had a delinked pull in place during this time period (PASTEUR has not yet passed in the US; Italy only recently kicked off their Pull incentive).

Thus the cost to governments is not the US $363m revenue guarantee per year, but instead that number reduced by actual revenues. We urgently need the Pull incentive because revenues for important new antibiotics are both too little and too late to sustain commercialization (more in this below). However, this does not mean that revenues are zero.

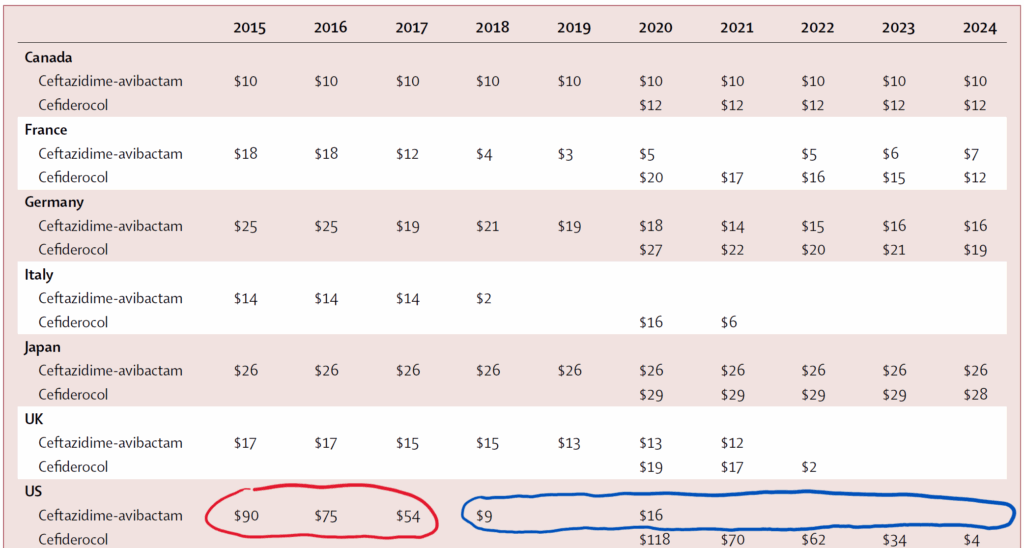

Digging a bit more deeply on this point, the table just below takes a look in detail at how much each country would have needed to add as top-up to reach fair share had a Pull incentive started when the product was approved in that country. Where there are no numbers, the top-up would have been zero … and one such spot is marked:

Shown in the table is the total top-up per year for the two drugs. This is the difference between sales revenue and the mid-point target for that country per year.

In reading the table, it is instructive to see how some countries would need to provide little (France) or no (US, Italy) at times. But, also note that question of timing. In its first 3 years on the market (red circle), sales revenue for ceftazidime-avibactam in the US was very small and thus a total top up of $219 would have been needed. But as sales revenue increased, only $25m would have been needed over the next 7 years. This is the problem of too little, too late … small companies cannot survive those early years without the support of a Pull incentive.

Second, there is the bigger question of whether or not a global Pull of $310m/yr x 10 years is fair in an overall context. We’ve looked at this before in terms of DALYs (disability-adjusted life years, an estimate of lives saved and reduced morbidity, see the 29 Apr 2024 newsletter (“R&D Implications: Global Burden of Disease is 28% Infectious!”), and as well in purely financial terms in the 29 Nov 2022 and 8 Dec 2022 newsletters (“Impact of PASTEUR: 9.9m lives saved, ROI of 125:1” and “Lives saved + ROI of PASTEUR-like Pull in Canada, UK, EU, Japan!”). But, is there another way to put this in context? Is it really over the top?

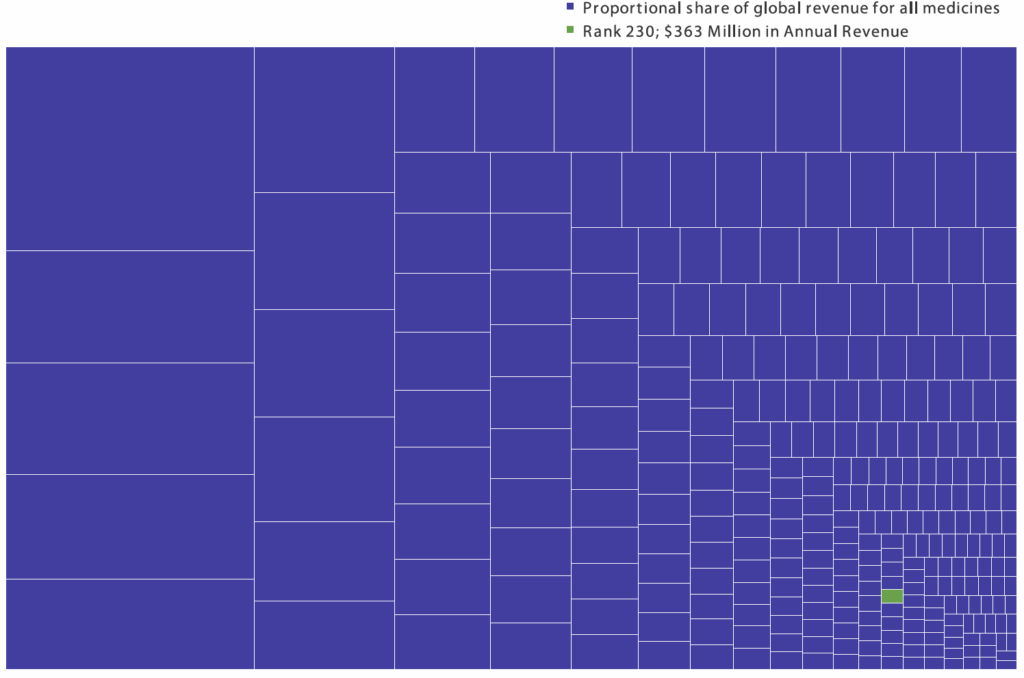

To answer that question, the authors estimated how an antibiotic would rank in global revenue vs. all the other drugs sold in all other categories if the antibiotic had 100% of a mid-range global Pull incentive (that is, $310m/yr x 10 years). Here we go:

It will likely take you a moment to find that tiny green box representing that antibiotic: it would be #230 in the global ranking for revenue!

Wow … that’s a powerful story! It really helps us see that the needed Pull is not an amount that is unreasonable in context. And, the power of the revenue guarantee by a Pull mechanism is very thoughtfully summarized by the authors:

- “Revenue guarantees would therefore most help support new antibiotics in the early years following market introduction.

- “While the top-up cost to governments will be lower than the revenue targets, for the small biotech companies responsible for most antibacterial innovation, this top-up is important as it sets a delinked floor for revenues, enabling investment to bring qualifying drugs to market and support commercialization and access in the years after launch.

- “Companies incur significant expenses to launch drugs in new countries; predictable revenue guarantees can support timely registration and access.”

It is also noteworthy that Pull incentives do not require the same structure in all countries. As the authors note “Progress in the UK and Italy demonstrates that meeting fair share targets are achievable within different national contexts.”

Inspiring and encouraging! With thanks to the UK and Italy for blazing a trail, it’s now time to see (further) progress in Europe (20 Jun 2025 newsletter, “Pull incentives in Europe: Next legislative steps”), Australia (21 Aug 2025 newsletter, “Australia calls for Subscription (‘Netflix’) models: Report and podcast”), Canada (8 Sep 2023 newsletter, “Canada says, ‘Let’s pull together!’ in a major new report”), Japan (22 Aug 2023 newsletter, “MHLW plan to pilot Pull incentives in Japan: Further details”), and the US (25 Sep 2024 newsletter, “26 Sep 2024 is a day of virtual advocacy: #PassPASTEUR”).

All best wishes, John & Kevin

John H. Rex, MD | Chief Medical Officer, F2G Ltd. | Operating Partner, Advent Life Sciences. Follow me on Twitter: @JohnRex_NewAbx. See past newsletters and subscribe for the future: https://amr.solutions/blog/. All opinions are my own.

Kevin Outterson, JD, Professor of Law, Boston University & Executive Director, CARB-X (these views are personal and do not necessarily reflect the views of CARB-X or any of its funders) @koutterson

John’s Top Recurring Meetings

Virtual meetings are easy to attend, but regular attendance at annual in-person events is the key to building your network and gaining deeper insight. My personal favorites for such in-person meetings are below. Of particular value for developers, the small meeting format of BEAM’s AMR Conference (March) and GAMRIC (September-October; formerly, the ESCMID-ASM conference series) creates excellent global networking. IDWeek (October) and ECCMID (April) are much larger meetings but also provide opportunities for networking with a substantial, focused audience via their Pipeline sessions. Hope to see you there!

- 1-3 Oct 2025 GAMRIC, the Global AMR Innovators Conference (London, UK). Formerly the ESCMID-ASM Joint Conference on Drug Development for AMR, this meeting series is now in its 10th year and is being continued under the joint sponsorship of CARB-X, ESCMID, BEAM Alliance, GARDP, LifeArc, Boston University, and AMR.Solutions. The ongoing series will continue the successful format of prior meetings with a single-track meeting and substantial networking time (go here to see details of the outstanding 2024 meeting).

- Registration is now open and the preliminary agenda can be found at that same link (https://www.gamric.org/). The meeting will be limited to approximately 300 attendees, so please be sure to register promptly to avoid disappointment!

- 19-22 Oct 2025 (Georgia, USA): IDWeek 2025, the annual meeting of the Infectious Diseases Society of America. Go here to register. For those who would like a substantial opportunity to present a product to a large audience (see also adjacent note about ESCMID), note the call for applications to present at an IDWeek Pipeline Session; go here to submit an application for your compound or diagnostic.

- 3-4 Mar 2026 (Basel, Switzerland): The 10th AMR Conference. Sponsored by the BEAM Alliance, the 9th AMR Conference has just concluded and it’s again been an excellent meeting! Please mark your calendar for next year. You can’t register yet, but details will appear here!

- 17-21 April 2026 (Munich, Germany): ESCMID Global 2026, the annual meeting of the European Society for Clinical Microbiology and Infectious Diseases. You can’t register yet, but you can go here for details on the outstanding 2025 meeting. For those who would like a substantial opportunity to present a product to a large audience (see also adjacent note about IDWeek), I know that the meeting schedule will again include Pipeline Monday; go here to see details from 2025.

Upcoming meetings of interest to the AMR community:

- 15-19 Sep 2025 (virtual): US CDC-sponsored the 9th Annual Fungal Disease Awareness Week (FDAW). Daily themed events include “Think Fungus” on 15 Sep, “Fungi are everywhere” on 16 Sep, and “Fungal diseases and drug resistance (19 Sep). Signup for the Mycotic Diseases Branch newsletter to stay updated.

- 1-3 Oct 2025 GAMRIC, the Global AMR Innovators Conference (London, UK; formerly the ESCMID-ASM Joint Conference on Drug Development for AMR). See list of Top Recurring meetings, above..

- 11-19 Oct 2025 (Annecy, France, residential in-person program): ICARe (Interdisciplinary Course on Antibiotics and Resistance) … and 2025 will be the 9th year for this program. Patrice Courvalin orchestrates content with the support of an all-star scientific committee and faculty. The resulting soup-to-nuts training covers all aspects of antimicrobials, is very intense, and routinely gets rave reviews! Seating is limited, so mark your calendars now if you are interested. Applications are being accepted from 20 Mar to 21 Jun 2025 — go here for more details.

- 17-20 Sep 2025 (Porto, PT): 14th International Meeting on Microbial Epidemiological Markers (IMMEM XIV). Go here for details.

- 9-13 Nov 2025 (Portland, OR, USA): ASM Conference on Biofilms. Go here for details and to register.

- 18-24 Nov 2025 (global, multiple locations): World Antibiotic Awareness Week (WAAW) is convened annually on 18-24 Nov by WHO with national events (e.g., CDC’s US Antibiotic Awareness Week (USAAW); ECDC’s 18 Nov European Antibiotic Awareness Day) occurring around the globe. Details will follow as events become visible.

- 19-22 Oct 2025 (Georgia, USA): IDWeek 2025. See list of Top Recurring meetings, above.

- 29-31 Oct 2025 (Bengalaru, India): ASM Global Research Symposium on the One Health Approach to Antimicrobial Resistance (AMR), hosted in partnership with the Centre for Infectious Disease Research (CIDR) at the Indian Institute of Science (IISc). Go here for details and to register.

- 28-30 Jan 2026 (Las Vegas, NV, USA): IDSA and ASM have announced a new US-based meeting series entitled IAMRI (Interdisciplinary Meeting on Antimicrobial Resistance and Innovation) and described as a “forum for collaboration and exploration around the latest advances in antimicrobial drug discovery and development.” You can’t register yet (the website says registration will open September 2025) but you go here for the program and to submit an abstract (deadline for abstracts is 1 Oct 2025).

- [NEW] 4-5 Feb 2026 (virtual, 8a-noon GMT on both days): Antimicrobial Chemotherapy Conference 2026, sponsored by BSAC and GARDP. Registration here: acc-conference.com. Abstracts are welcomed and can be submitted here; abstract deadline is Friday, 14 November 2025, 17:00 GMT.

- 3-4 Mar 2026 (Basel, Switzerland): The 10th AMR Conference sponsored by the BEAM Alliance. See list of Top Recurring meetings, above.

- 8-13 Mar 2026 (Renaissance Tuscany Il Ciocco, Italy): 2026 Gordon Research Conference (GRC) entitled “Antibacterials of Tomorrow to Combat the Global Threat of Antimicrobial Resistance.” A Gordon Research Seminar (GRS) will be held the weekend before (7-8 Mar) for young doctoral and post-doctoral researchers. Space for the GRS and the GRC is limited; for details and to apply, go here for the GRC and here for the GRS.

- 17-21 April 2026 (Munich, Germany): ESCMID Global 2026, the annual meeting of the European Society for Clinical Microbiology and Infectious Diseases. See Recurring Meetings list, above.

- 4-8 June 2026 (Washington, DC): ASM Microbe, the annual meeting of the American Society for Microbiology. The meeting format is evolving and next year will combine 3 meetings (ASM Health, ASM Applied and Environmental Microbiology, and ASM Mechanism Discovery) into one event. Go here for details.

Self-paced courses, online training materials, and other reference materials:

- OpenWHO: “Antimicrobial Resistance in the environment: key concepts and interventions.” Per the webpage for the course, it will teach you “…why addressing AMR in the environment is essential and gain insights into how action can be taken to prevent and control AMR in the environment at the national level.” This course builds on WHO’s 2024 Guidance on wastewater and solid waste management for manufacturing of antibiotics. For further reading, see also the 25 Sep 2023 newsletter entitled “Manufacturing underpins both access and stewardship: Cefiderocol as a case study” and the 28 Jan 2024 newsletter entitled “EMA Concept Paper: Guidance on manufacturing of phage products”.

- GARDP’s REVIVE website provides an encyclopedia covering a range of R&D terms, recordings of prior GARDP webinars, a variety of viewpoint articles, and more! Check it out!

- GARDP’s https://antibioticdb.com/ is an open-access database of antibacterial agents.

- The CARB-X website provides a range of recordings from its webinars, bootcamps, and more. A bit of browsing would be time well spent!

- British Society for Antimicrobial Chemotherapy offers an eLearning section: Education – The British Society for Antimicrobial Chemotherapy.

- NNF (Novo Nordisk Foundation) have announced their “Challenge Programme 2026 – Unravelling the Pathways of Human Invasive Fungal Diseases. The call seeks applications from EU-centered consortia (global partners are possible) for research in 4 areas: (i) fungal virulence factors, (ii) host-pathogen interactions, (iii) mechanisms of anti-fungal resistance, and (iv) fungal disease markers. Applications are due by 8 Oct 2025. Go here for details.

- ENABLE-2 has continuously open calls for both its Hit-to-Lead program as well as its Hit Identification/Validation incubator. Applicants must be academics and non-profits in Europe due to restrictions from the funders. Applications are evaluated in cycles … see the website for details on current timing for reviews.

- CARB-X will have two calls during 2025 that span two areas: (i) Small molecules for Gram-negatives (the focus is on Pseudomonas aeruginosa) and (ii) Diagnostics for typhoid (the focus is diagnosis of acute infections in 60 minutes or less). See this 26 Feb 2025 newsletter for a discussion of the call and go here for the CARB-X webpage on the call. The first cycle is now closed (it ran16-30 April 2025); the 2nd round will be open 1-12 Dec 2025.

- BARDA’s long-running BAA (Broad Agency Announcement) for medical countermeasures (MCMs) for chemical, biological, radiological, and nuclear (CBRN) threats, pandemic influenza, and emerging infectious diseases is now BAA-23-100-SOL-00004 and offers support for both antibacterial and antifungal agents (as well as antivirals, antitoxins, diagnostics, and more). Note especially these Areas of Interest: Area 3.1 (MDR Bacteria and Biothreat Pathogens), Area 3.2 (MDR Fungal Infections), and Area 7.2 (Antibiotic Resistance Diagnostics for Priority Bacterial Pathogens). Although prior BAAs used a rolling cycle of 4 deadlines/year, the updated BAA released 26 Sep 2023 has a 5-year application period that ends 25 Sep 2028 and is open to applicants regardless of location: BARDA seeks the best science from anywhere in the world! See also this newsletter for further comments on the BAA and its areas of interest.

- HERA Invest was launched August 2023 with €100 million to support innovative EU-based SMEs in the early and late phases of clinical trials. Part of the InvestEU program supporting sustainable investment, innovation, and job creation in Europe, HERA Invest is open for application to companies developing medical countermeasures that address one of the following cross-border health threats: (i) Pathogens with pandemic or epidemic potential, (ii) Chemical, biological, radiological and nuclear (CBRN) threats originating from accidental or deliberate release, and (iii) Antimicrobial resistance (AMR). Non-dilutive venture loans covering up to 50% of investment costs are available. A closing date is not posted insofar as I can see — applications are accepted on a rolling basis; go here for more details.

- The AMR Action Fund is open on an ongoing basis to proposals for funding of Phase 2 / Phase 3 antibacterial therapeutics. Per its charter, the fund prioritizes investment in treatments that address a pathogen prioritized by the WHO, the CDC and/or other public health entities that: (i) are novel (e.g., absence of known cross-resistance, novel targets, new chemical classes, or new mechanisms of action); and/or (ii) have significant differentiated clinical utility (e.g., differentiated innovation that provides clinical value versus standard of care to prescribers and patients, such as safety/tolerability, oral formulation, different spectrum of activity); and (iii) reduce patient mortality. It is also expected that such agents would have the potential to strongly address the likely requirements for delinked Pull incentives such as the UK (NHS England) subscription pilot and the PASTEUR Act in the US. Submit queries to contact@amractionfund.com.

- INCATE (Incubator for Antibacterial Therapies in Europe) is an early-stage funding vehicle supporting innovation vs. drug-resistant bacterial infections. The fund provides advice, community, and non-dilutive funding (€10k in Stage I and up to €250k in Stage II) to support early-stage ventures in creating the evidence and building the team needed to get next-level funding. Details and contacts on their website (https://www.incate.net/).

- These things aren’t sources of funds but would help you develop funding applications

- The Global AMR R&D Hub’s dynamic dashboard (link) summarizes the global clinical development pipeline, incentives for AMR R&D, and investors/investments in AMR R&D.

- Antimicrobial Resistance Research and Innovation in Australia is an actively updated summary that covers Australia’s AMR research and patent landscape. It is provided via collaboration between The Lens (an ambitious project seeking to discover, analyse, and map global innovation knowledge) and CSIRO (Commonwealth Scientific and Industrial Research Organisation, an Australian Government agency responsible for scientific research). Lots to explore here!

- Diagnostic developers would find valuable guidance in this 6-part series on in vitro diagnostic (IVD) development. Sponsored by CARB-X, C-CAMP, and FIND, it pulls together real-life insights into a succinct set of tutorials.

- In addition to the lists provided by the Global AMR R&D Hub, you might also be interested in my most current lists of R&D incentives (link) and priority pathogens (link).